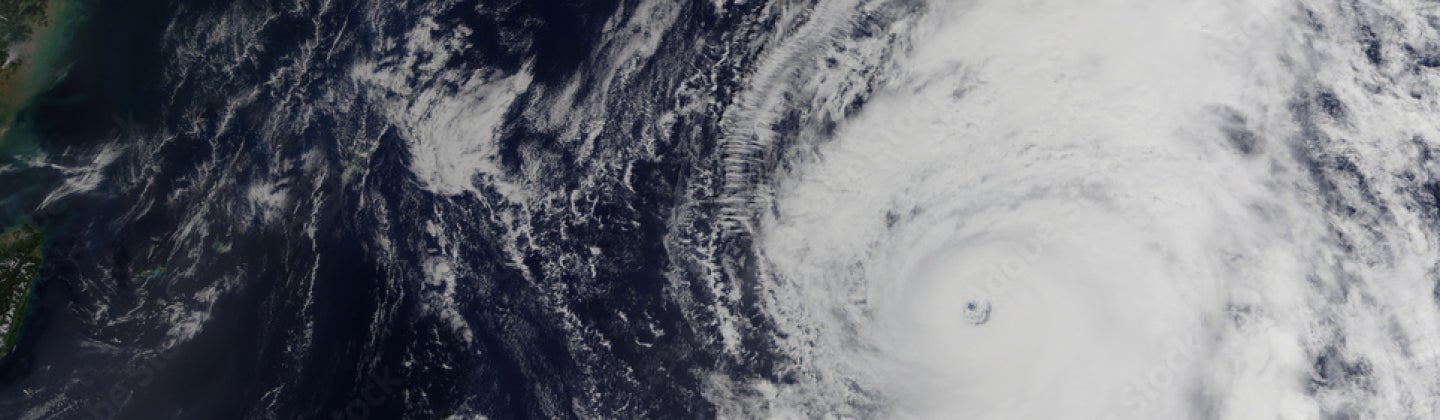

The insurance industry faces a recurring challenge that can be likened to an intense 200-meter sprint – the biannual navigation through the model change management process to implement the latest North Atlantic Hurricane risk models.

The Florida Commission on Hurricane Loss Projection Methodology (FCHLPM) has announced the approval of Version 23 of Moody’s RMS North Atlantic Hurricane Models for use in residential rate filings with the Florida Office of Insurance Regulation.

Insurers, brokers, and reinsurers anticipating using the latest view of risk for real-time hurricane analysis for their 1/1 treaty renewals, will now be looking to update their views of risk as fast as possible.

To achieve this, market participants writing business in the North Atlantic coastal hurricane region are therefore challenged to complete the entire change management process in a timely manner.

Introducing Version 23

The upcoming Moody’s RMS release of Version 23, including the Moody’s RMS North Atlantic Hurricane Models on June 14, will deliver significant material changes compared to its predecessor Version 21 released in 2021, and represents the most significant improvement to vulnerability modeling since Version 15 in 2015, most notably:

- Revised long-term event rates (LTR) and medium-term rates (MTR) across the entire North Atlantic Basin.

- Significant vulnerability enhancements to residential and non-residential lines – notably the elimination of the alternative vulnerability for Florida residential lines that were available in Version 21.

- The introduction of software functionality to allow model users to better reflect their opinion of dynamic market conditions or non-modeled sources of loss directly within the model framework (i.e., custom post-event loss amplification).

- Hazard updates, including a newer vintage of underlying land use-land cover data for Florida.

Together, these updates will provide the most advanced outlook on North Atlantic hurricane risk. This all helps (re)insurers to better prepare for the upcoming season as they continue to grapple with a range of challenges that arise from rising inflation, a changing climate, and legislative changes to the Florida marketplace.

The Recurring Cost of Model Change Management

But, enhancing your understanding of hurricane risk through investments in science and data does not come without a price.

According to feedback from an on-premises Moody’s RMS RiskLink® customer, when factoring in direct and indirect expenses, such as procuring IT infrastructure for the test environment, migrating data, and allocating personnel from IT and cat modeling teams to support the change management process, their change management process can cost up to US$250,000.

Even prior to model validation, multiple steps must be undertaken to get prepared which in themselves can take weeks to complete, potentially causing delays in using the new model in production workflows, including:

- Budget planning and procurement for any new hardware requirements for change management.

- Installation and upgrade of the new environment for model validation.

- Migration of live portfolio data from the current production environment to the new testing environment.

- Conducting user acceptance testing and running model analysis to confirm replication of the previous version of model results with a thorough understanding of the change, and its impact on key business decisions.

- Maintenance and upkeep of both the production and change management system to ensure that business-as-usual activities will not be disrupted.

In anticipation of the next 1/1 renewals in 2024 and the requirement to use the new FCHLPM-approved models for rate setting from November 2023 onwards, Moody’s RMS has recommended that customers running the North Atlantic Hurricane models on RiskLink on-premises catastrophe modeling software should start their change management process even before the model is released.

To do this, we have provided technical guidance as well as robust documentation on the changes in losses and the model methodology. Even with this guidance, on-premises firms still face the prospect of migrating a large portfolio of accounts into a new testing environment within a very tight timeframe.

The Power of Cloud-Native Technology and Change Management

In his famous 1990 interview, Steve Jobs described the personal computer as a “bicycle for the mind,” emphasizing our innate ability as humans to augment our capabilities through tools to achieve extraordinary feats.

For an industry with roots dating back to the seventeenth century, the insurance industry has certainly harnessed this concept, progressing from archaic paper ledgers to cutting-edge, technology-enabled analytics.

The past two decades have witnessed a profound transformation. The digital revolution has permeated every aspect of the value chain, with risk analytics assuming a prominent role and delivering substantial advancements across insurance functions, spanning from underwriting to capital management.

Extending the analogy of the hurricane change management sprint, the cloud can be likened to a ‘bicycle’ for model validation. In a world where everyone needs to work smarter, not harder, Moody’s RMS Risk Modeler™, our cloud-native catastrophe modeling application hosted on the Moody’s RMS Intelligent Risk Platform™ (IRP), can help you gain a competitive advantage.

By using Risk Modeler, change management processes will be faster and completed with fewer resources and less effort, and at a lower cost. Conversely, companies reliant on on-premises environments for model validation will still find themselves entangled in an arduous change management process.

Risk leadership at firms using on-premises environments can anticipate months of Zoom and Microsoft Teams-dominated budget discussions, with IT teams dedicating weeks to establishing the new environment, and cat modelers devoting extended periods to conducting model validation.

As you consider all the time and effort required to update a new model, the table below offers a brief comparison of the difference between model change management with on-premises RiskLink versus the cloud-based Risk Modeler application.

| Change Management Steps |

RiskLink On-Premises Environment |

Risk Modeler Cloud-Native Environment |

|---|

| IT Planning and Procurement for New Environment(s) |

Long IT budgeting, procurement, and planning process. |

No additional IT procurement needed. |

| New Environment Provisioning |

IT department builds new environment(s) for user acceptance testing and change management. |

Change management runs on an existing cloud-native environment. |

| Model Software Installation and Maintenance |

IT downloads and installs model software in new environment. Monitors and maintains during change management. |

The new model becomes instantly available in Risk Modeler at release. No new software installation needed. |

| Portfolio Data Migration |

Duplicate and migrate live portfolio data to new testing environment |

No data migration is needed. New and existing models share the same portfolio data for analysis. |

| Workflow Software Support |

IT updates software across the entire workflow - like SQL server - to support new release. |

SaaS model keeps workflow software up to date. |

| Workflow Integration |

IT builds new workflows that feed into existing systems. |

Leverages existing workflows from the production environment. |

| Portfolio Analysis and Model Validation |

Model runs can last days or weeks to complete. |

SaaS environment can run models up to 36x faster. |

| Update Model Across Systems |

Manually update systems with software and model enhancements. |

View of risk can be applied automatically across all IRP applications. |

| Post-change management |

Maintain new and old production environments. Customer data remains on both systems. |

Customer data remains secure in the unified data store. |

Conclusion

The insurance industry is no stranger to the challenges posed by model change management, particularly in the context of North Atlantic Hurricane models. As insurers start to act after the release of approved models by the FCHLPM and the impending (re)insurance renewal calendar deadlines, the pressure is on to swiftly update risk assessments and rates.

By embracing the power of the cloud, firms can streamline their change management process, reducing resource requirements, effort, and costs.

With over 100 customers leveraging the power, scale, and reliability of Moody’s RMS Intelligent Risk Platform, there has never been a safer time to consider migrating from RiskLink to Risk Modeler.

To learn more, check out additional details on the Risk Modeler here, or contact your Moody’s RMS customer support manager.